21 Apr Natural Gas Flaring, Part 3: Economic Based Flaring

The exponential increase in flaring for economic reasons has become the prime mover in the current natural gas flaring discussion. For instance, from 2010 to 2019 the Texas Railroad Commission reported a 20X increase in flaring permit applications, going from approximately 300 in 2010 to 7000 in 2019. Those are big numbers, but data always needs to be kept in context. As of 2019 data, there were approximately 265,000 producing wells in the State of Texas. Against this total, the 7000 looks less staggering.

Economic based flaring occurs when a well is completed that is capable of producing both oil and natural gas, and the well economics dictate that the oil production be accelerated at the expense of natural gas. Flaring in this context typically lasts months, and certain cases longer.

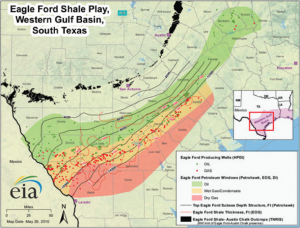

But how could it be economically rational to simply burn these valuable hydrocarbons? And why the 20X increase over the past decade? Let’s take these in turns, and start with why we have seen an exponential increase in flaring. Over the past decade, the major operational focus in Texas for new exploration has been on liquids, primarily oil. From 2010 to 2014, the bulk of this occurred in the Eagle Ford region of South Texas. Characterized by three ‘windows’ – Oil, Wet Gas/Condensate, and Dry Gas – Eagle Ford wells tend to produce large quantities of natural gas, which increases/decreases dependent upon their north to south orientation along the play, as this map shows.

Source: U.S. Energy Information Administration (May 29, 2010)

While oil and gas development has occurred in South Texas for decades, the scale of Eagle Ford development immediately outpaced the midstream gathering capacity required to move these new volumes of natural gas to market. As previously mentioned, unlike oil, there is no efficient method of storing produced gas short of re-injection into a reservoir. It cannot be held in tanks or trucked in the same manner as oil. Thus, it either must be moved to market, reinjected, or burned. Note that new carbon capture technologies are changing this simple three-part choice, most if not all of which were not available or commercial in the 2010-14 timeframe.

Much of the development in the Eagle Ford necessitating new gathering systems was occurring in areas that lacked any meaningful gas gathering infrastructure. In addition to the simple time factor in building out a midstream system, there are also significant economic decisions that must be made. For one, are the volumes of gas produced enough to support the build-out of an expensive midstream system? What about the price risk of natural gas? Recall that in the 2010-to-2014 time frame, literally everything in the oil field was slower and more expensive due to the high demand.

Faced with slow and expensive midstream buildouts to move the economically less desirable natural gas to market, operators had to factor in additional complicating variables:

-

-

- Their cost of capital, which changed radically from private equity backed companies to publicly traded one.

- Competition for investment among other options in their portfolio. How does this same dollar spent on Eagle Ford midstream stack up against drilling additional wells, or drilling wells in other assets outside of the Eagle Ford?

- Cost and likelihood of acquiring the rights-of-way to build pipelines.

- Lease terms.

-

Operators were forced to weigh delaying oil production in favor of expensive, slow, and at times uncertain midstream build-outs to gather the associated gas. Simply put, the economics in most cases did not support delaying oil production. That is, the economics dictated that liquids production be accelerated even when flaring 100% of natural gas production was required.

This same scenario played itself out in basins across Texas and the country, most notably in the Permian’s Delaware Basin. According to U.S. Department of the Interior estimates from 2019, an operator in the Delaware Basin targeting the Wolfcamp formation was faced with an oil to gas commodity price ratio of 28:1. According to these estimates, should an operator flare 100% of all gas produced in the first year and pay landowner royalties on these volumes, the loss of gas sales revenue had only a minimal impact on overall well economics, raising the breakeven cost from $42/bbl to $45/bbl.

The main takeaway here is that economics drives behavior. The primary reason why we are seeing an exponential increase in flaring is due to well economics supporting the acceleration of liquids production over any delays in order to gather gas. Restated, curtailing liquids-focused operations to wait for gas takeaway can result in a net economic loss to the operator. Short of radical overhaul of the Texas flaring regime (which we will discuss shortly), the economics will be the key to changing behavior. With the Texas legislature currently in session and flaring on the front of everyone’s mind, it is likely that we will see some regulatory/administrative movement on this front. However, note that barring legislative action, which is unlikely due to more pressing issues, the Texas Railroad Commission tends to move incrementally.

Sorry, the comment form is closed at this time.